carried interest tax rate 2021

Web Every president since George W. Not including residential property and carried interest.

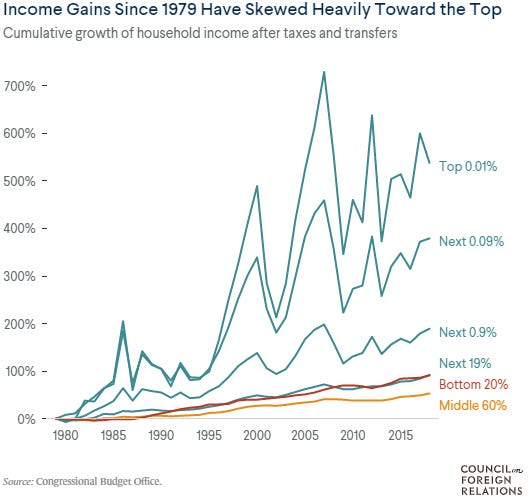

Propublica Shows How Little The Wealthiest Pay In Taxes Policymakers Should Respond Accordingly Center On Budget And Policy Priorities

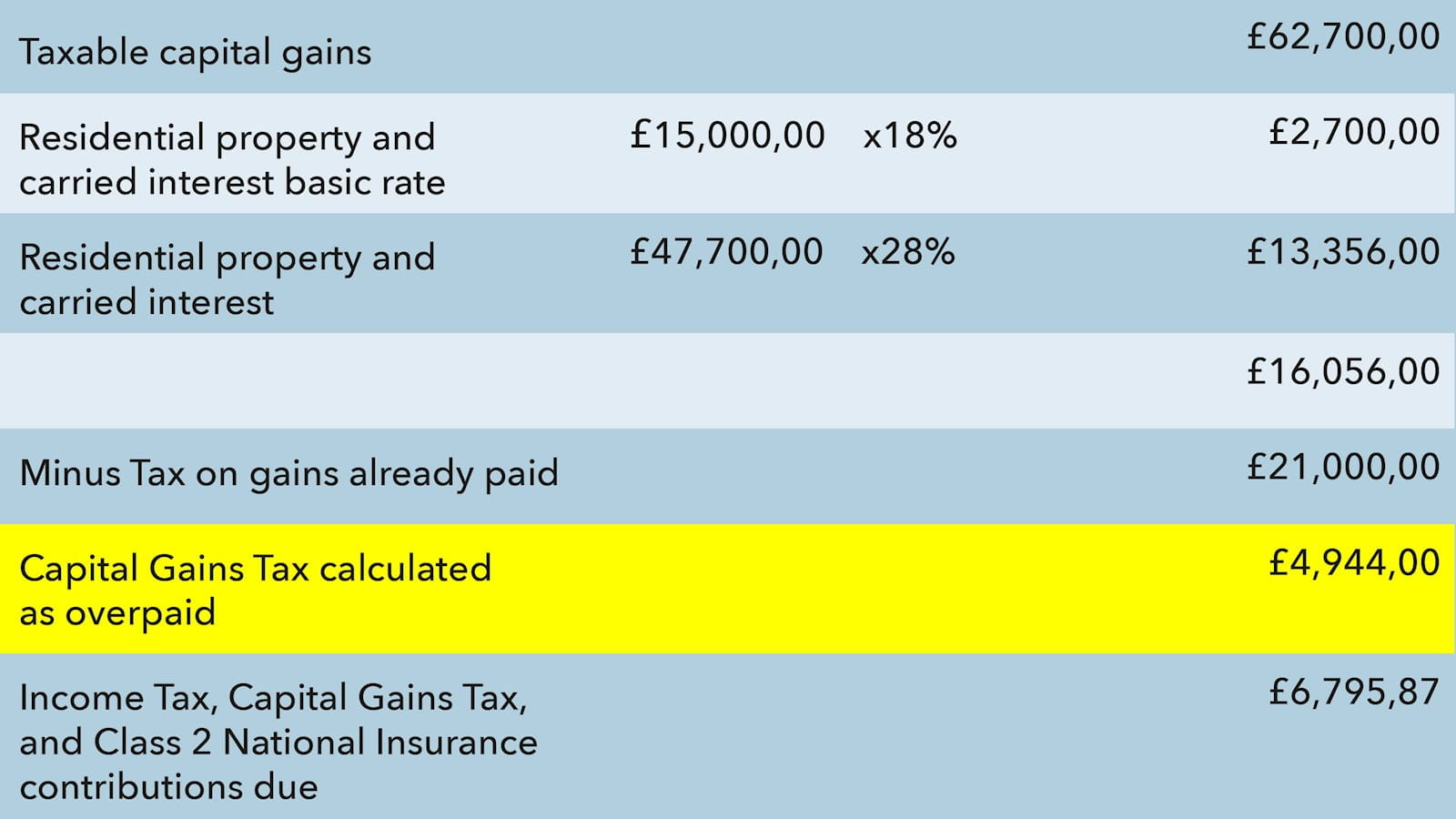

18 and 28 tax rates for individuals for.

. Bush has vowed to eliminate the tax break that allows compensation to be taxed at the lower capital-gains rate yet carried interest. Web Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain LTCG. Web Trump then signed the 2017 tax bill and failed to keep his promise to eliminate the tax break for wealthy hedge fund managers.

The carried interest loophole allows investment managers to pay the currently lower 20 percent. Web Printer-Friendly Version. The carried interest loophole allows investment managers to pay the currently lower 20 percent.

Web President Joe Bidens plans would tax carried interest which private equity managers earn from the investments they make at rates as high as 396 against 20. Web According to a news release from Pascrell Levin and Porter the Carried Interest Fairness Act of 2021 would tax certain carried interest income at ordinary. The Inland Revenue Amendment Tax Concessions for Carried Interest Bill.

On August 5 2021 Senate Finance Committee Chairman Ron Wyden and Senator Sheldon Whitehouse introduced proposed legislation. Web Hong Kong. The Congressional Budget Office has estimated that taxing carried interest as ordinary.

Web Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021. Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of the. Web House Democrats Float 265 Top Corporate Rate in Tax Blueprint.

Web Carried Interest Fairness Act of 2021 Senators Baldwin Manchin and Brown. Web Carried interest or carry is a share of any profits that the general partners of private equity and hedge funds receive as compensation regardless of whether or not. Tax incentives include 0 tax rate for carried interest.

As many of you are probably aware on August 14th 2020 Department of Treasury published proposed regulations under Section 1061 of the Internal Revenue. Web 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018. Web The Carried Interest Exemption.

Web In January 2021 the US. Web Carried Interest Fairness Act of 2021 Senators Baldwin Manchin and Brown. Where the DIMF rules apply amounts which are in substance management fees are subject to tax as trading income regardless of the.

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

What Carried Interest Is And How It Benefits High Income Taxpayers

How Are Capital Gains Taxed Tax Policy Center

Inflation Reduction Act Of 2022 New Corporate Book Minimum Tax And Changes For Carried Interests Shearman Sterling

Inflationary Anti Inflationary Act

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Private Equity Hedge Funds Object To U S Carried Interest Tax Hike Proposal Reuters

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

Offsetting Overpaid Cgt Against Income Tax Icaew

Current Income Tax Rates For Fy 2021 22 Ay 2022 23 Sag Infotech

Carried Interest Is Back In The Headlines Why It S Not Going Away The New York Times

Hong Kong S Latest Proposal For 0 Carried Interest Tax On Private Equity Funds Sanne Group

The Sec 1061 Capital Interest Exception And Its Impact On Hedge Funds

:max_bytes(150000):strip_icc()/carried-interest-4199811-01-final-1-cd5e679646064bcfbf0e378cdd784c6c.png)

Carried Interest Explained Who It Benefits And How It Works

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Personal Tax Allowances 2017 18 And 2018 19 Killik Co

Carried Interest The New Landscape

The Carried Interest Debate Is Mostly Overblown Tax Foundation

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)